The Account-Based Marketing (ABM) platform market has witnessed a few significant changes. Marketing and sales teams are now demanding unified data, AI-powered orchestration, and faster pipeline acceleration.

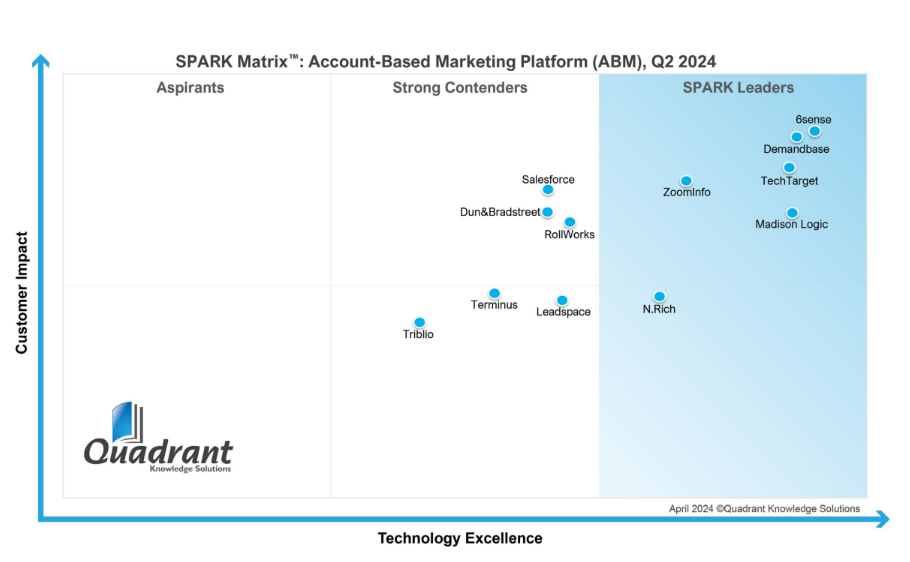

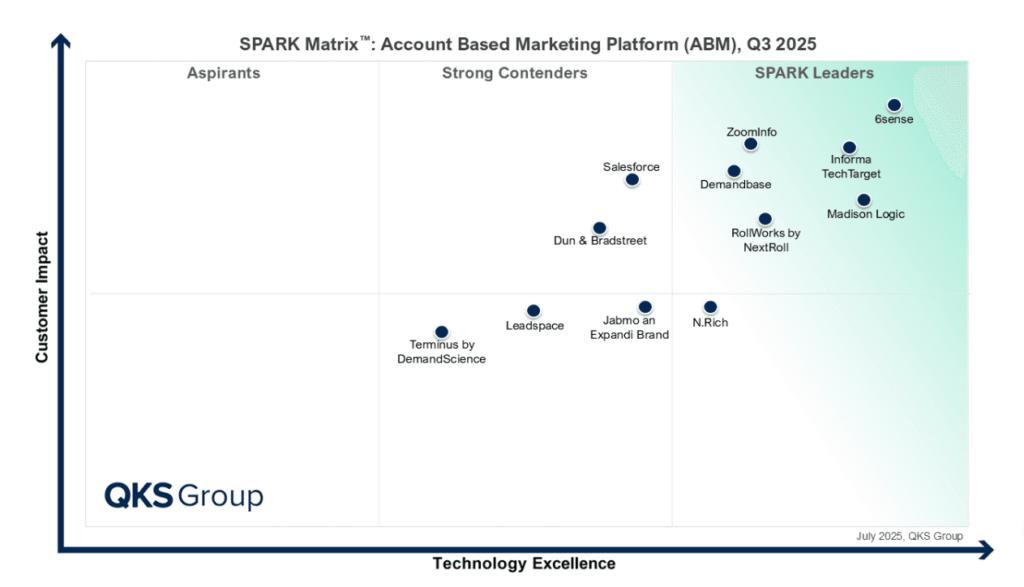

QKS Group (formerly Quadrant Knowledge Solutions) recently published its SPARK Matrix™ for ABM Platforms for Q3 2025, offering a data-backed view of how leading ABM platforms are performing across Technology Excellence and Customer Impact.

We analyzed and compared both the 2024 and 2025 SPARK Matrix reports to uncover how vendors are repositioning amid consolidation, innovation, and shifting enterprise needs.

The Leaders

Most of the leaders in 2024 have also been positioned as leaders in 2025, with one exception, which went from being a strong contender in 2024 to a leader in 2025. This indicates that the key vendors have maintained their leadership status by keeping up with evolving expectations and enhancing their key capabilities.

The following section highlights some key strengths of the vendors that have been positioned as leaders for two consecutive years, as well as a new leader in the 2025 SPARK Matrix.

6sense

6sense continues to dominate the ABM landscape with its Revenue AI™ platform. It offers predictive intent insights, advanced orchestration, and unified sales-marketing alignment. Its platform has been praised for making complex B2B journeys trackable and actionable through automation and generative AI features. In both 2024 and 2025, it remained the highest-ranked Leader, with particularly strong customer feedback.

Demandbase

Demandbase also retained its position as a top-tier Leader. Its ABX Cloud platform offers tight integration across sales, marketing, and intent data, which continues to drive results for large businesses. In 2025, the platform added generative AI capabilities, improved native engagement, and strengthened its position through measurable ROI and deeper partner integration.

Informa TechTarget

Informa TechTarget (formerly TechTarget) offers a robust purchase intent engine and embedded GTM tools like Priority Engine and IntentMail AI. It enables both marketing and sales teams to act quickly on verified buyer signals. The merger with Informa enhanced its reach, content-driven intent data, and customer engagement capabilities, cementing its place among the top-tier leaders.

Madison Logic

Madison Logic continued its momentum in the Leader quadrant, focusing on omnichannel program execution and deep account analytics. The platform is preferred by enterprise clients for its ability to tie intent, content, and pipeline into a single reporting framework.

ZoomInfo

ZoomInfo continued to invest in combining contact data, sales intent, and ABM activation tools, which helped it solidify its position in the 2025 Leader quadrant. The platform excels at integrating seamlessly into sales and marketing workflows.

RollWorks (A New Leader in 2025)

Promoted from Strong Contender in 2024 to Leader in 2025, Roll Works by Next Roll earned its spot through product enhancements in orchestration, segmentation, and measurement, particularly for mid-market users. The platform’s modular pricing and easy-to-use UI helped boost adoption and impact.

N.Rich

N.Rich unifies intent, content, and campaign automation. It turns intent data into well-targeted multi-touch advertising journeys. In addition, its targeting engine and ad builder are specifically built for account-based marketing use cases. In 2025, N.Rich introduced new integrations, expanded analytics, and improved platform usability, which helped reduce friction for marketing teams looking to operationalize ABM quickly.

Steady Contenders

Salesforce

Salesforce remained a Strong Contender for two consecutive years. It offers powerful capabilities via Data Cloud, Account Engagement (Pardot), and Sales Cloud, but still lacks a fully unified ABM execution layer. Its strength lies in flexibility and CRM-centric GTM motion.

Dun & Bradstreet

Dun & Bradstreet remains a trusted foundation for data enrichment and audience segmentation, offering exceptional depth in firmographic and account intelligence. While its core strength lies in delivering high-quality insights, the platform is gradually expanding its capabilities. As it continues to evolve, there is strong potential for D&B to play a bigger role in activation and campaign orchestration.

Leadspace

Leadspace remained a consistent contender in 2024 and 2025. It offers strong identity resolution and data enrichment capabilities. Leadspace Studio provides teams with an easy-to-use interface. It helps marketers build and manage campaign segments and prioritize the accounts that sales should focus on.

Terminus

Terminus offers an intuitive interface and pre-built campaign templates, which are especially valuable for teams looking to quickly launch and scale account-based programs. It is seen to have moved down slightly from 2024 to 2025. While its display and chat offerings remain strong, its rate of product innovation might have slowed.

Contender in 2024

Triblio

Triblio, which was previously in the Strong Contenders category in 2024, was not included in the 2025 Matrix. As the ABM landscape continues to evolve toward more integrated, multi-channel engagement and closer sales-marketing alignment, platforms focused primarily on web personalization may find it challenging to keep pace with broader market demands.

Contender in 2025

Jabmo

Jabmo, under the Expandi umbrella, was featured as a Strong Contender in the 2025 SPARK Matrix. Its verticalized ABM approach for industries like manufacturing and healthcare appears to be paying off, as does its increased investment in real-time reporting and integrations.

Final Take

After comparing the 2024 and 2025 SPARK Matrix reports, the message is clear: apart from intent signals, ABM platforms must also drive coordinated action across sales and marketing. Today’s top ABM platforms offer go-to-market engines, connecting marketing, sales, and customer success as a unified revenue strategy.

Platforms that earned or retained Leader status have demonstrated strengths in real-time engagement, scalable personalization, and a strong AI roadmap. To stay competitive, vendors should focus on connected go-to-market ecosystems with native orchestration and measurable impact.

According to Vaishnavi, Senior Analyst at QKS Group, “Account Journey Management and Account-Based Sales Intelligence have become critical requirements in ABM platforms, extending beyond marketing to empower the broader revenue team. Vendors are now expected to deliver personalized messaging across a broader portfolio of channels than previously offering native or integrated support for display, connected TV, digital audio, video, & social media ads, web personalization, content syndication, and sales engagement platforms, among other emerging channels, while providing AI-driven sales intelligence that enables both marketing and sales to act on unified insights to drive measurable business impact.”