The Contact Center as a Service (CCaaS) market is experiencing significant advancements in cloud-native technology. AI, real-time analytics, and digital channels have become standard offerings, encouraging vendors to differentiate themselves based on performance outcomes.

The Leaders

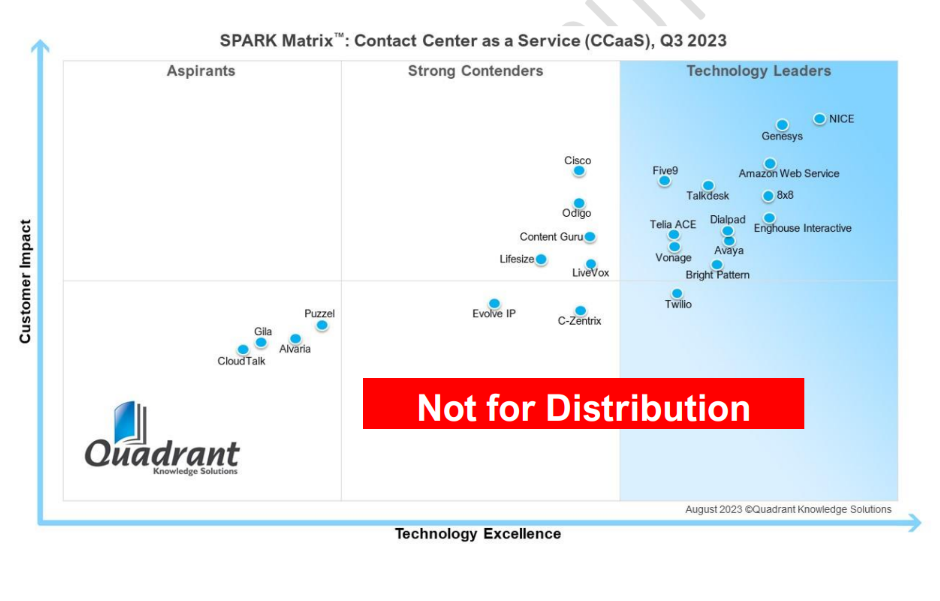

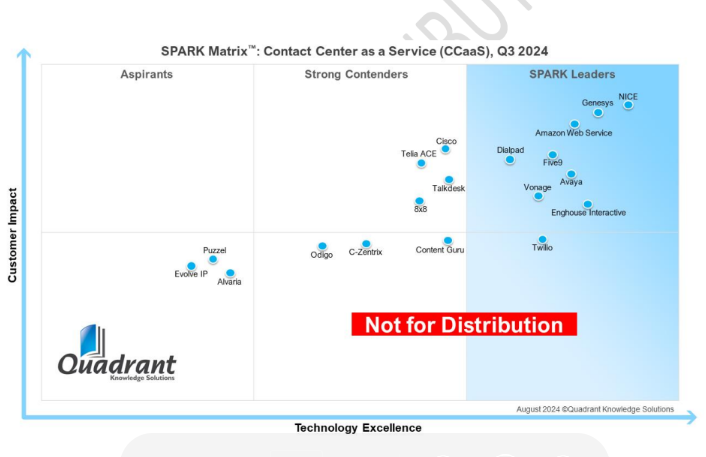

At first glance, the most obvious difference is that the Leaders’ quadrant in the 2023 SPARK Matrix™ looks rather cluttered, while the 2024 matrix appears to have a more even distribution between the leaders and strong contenders. NICE, Genesys, Five9, Amazon Web Services, Dialpad, Vonage, Avaya, Enghouse, and Twilio remained in the Leaders’ quadrant for two consecutive years. Some of their key CCaaS capabilities have been mentioned below, demonstrating their standing as Leaders in 2023 and 2024.

NICE

NICE leads with an enterprise-grade CCaaS suite featuring AI, analytics, and omnichannel capabilities. Its Enlighten AI, proactive workforce engagement management (WEM), and robust market presence make it a top choice for enterprises.

Genesys

Genesys offers a unified, cloud-native architecture. It focuses on experience orchestration and native AI tools. It also aims to make CX personal, at scale. Its roadmap includes enhanced self-service and conversational AI.

Amazon Web Services (AWS)

Amazon offers a low-code, flexible architecture, making it a popular choice among enterprises. It also provides seamless integration with the AWS ecosystem and a pay-as-you-go pricing model that scales with customer needs.

Five9

Five9 has robust WFO tools and an AI-augmented agent experience. It is preferred by businesses that want both traditional reliability and modern flexibility.

Dialpad

Dialpadoffers real-time transcription, sentiment analysis, and AI-powered coaching. What makes it unique is how its AI layer is integrated across both CCaaS and UCaaS workflows, providing organizations with a unified communications experience that is modern, efficient, and insight rich.

Vonage

Vonage’sCCaaS platform is both developer-centric and API-driven.It helps organizations build highly customized customer engagement flows, making it ideal for the e-commerce and logistics industries.Its strengths in 2023 were its flexible and programmable CX layer, whereas in 2024, it demonstrated continued growth by investing in AI, video, and omnichannel messaging.

Avaya

Avayafocuses on cloud migration and hybrid capabilities. Its OneCloud platform is particularly well-suited for organizations that operate in high-volume or highly regulated environments.

Enghouse Interactive

Enghouseoffers a broad range of features, such as omnichannel engagement, intelligent routing, and quality monitoring. It also has a strong partner network and local support, particularly in North America and Europe.

Twilio

Twilio’sFlex, its cloud-native CCaaS offering, is customizable, scalable, and developer-friendly. It is appealing to start-ups and digital-first companies that want to build customized CX solutions from the ground up.

A Few Shifts

Talkdesk

Talkdesk, which was positioned as a Leader in the 2023 SPARK Matrix, slipped down into the Strong Contenders list in 2024. Talkdesk’s strength lies in automation-first CX, with rapid innovations in retail and healthcare verticals. Its platform’s agility and native AI make it suitable for mid-to-large enterprises. One of the reasons why it could have seen a drop in position is because of possible gaps between vision and execution, particularly in terms of customer adoption at scale.

Telia ACE

Telia ACE, which was also positioned as a Leader in 2023, was seen in the Strong Contenders category in 2024. Its CCaaS solutions are popular in the Nordic region, particularly owing to its ability to offer tailored CX solutions based on the unique needs of healthcare and municipalities. Its slightly lower rankings in 2024 could be attributed to its limited investments in AI and advanced automation.

8×8

Another vendor that shifted from leader in 2023 to Strong Contender in 2024 is 8×8. It offers a unified UCaaS and CCaaS platform, which is appealing to mid-market and enterprise buyers looking to simplify their stack. On the downside, its all-in-one approach can make it more challenging for them to move fast with specialized CCaaS innovation. While other vendors are focusing on GenAI or real-time coaching, 8×8 has to balance competing priorities across UC and CC product lines. Furthermore, customer feedback indicates inconsistent support and integration pain points, particularly in complex deployments.

Evolve IP

Evolve IP was positioned as a Strong Contender in 2023 but shifted lower to the Aspirants category in 2024. The company traditionally focused on strengthening its hybrid work infrastructure and tailored contact solutions, especially for healthcare and financial services. However, it has been relatively sluggish in demonstrating advancements in AI-driven insights and self-service orchestration. Therefore, while it still caters to a loyal niche, it had a comparatively slower pace of innovation, which explains its change in ranking.

Consistent Contenders

Cisco and Content Guru remained Contenders for two consecutive years. Cisco’s Webex Contact Center is a reliable enterprise-grade solution. However, it may lag in innovation speed compared to the leaders. On the other hand, Content Guru is known for its storm platform and adoption in healthcare and emergency services. Its rankings may have slipped in 2024 due to lower customer impact scores and relatively slower progress in areas like digital engagement, AI, and overall CX agility.

Notable Exits

Bright Pattern, Glia, CloudTalk, Lifesize, and LiveVox, which were part of the 2023 SPARK Matrix, were not included in the 2024 graph. This could be owing to the narrowing of market focus, strategic shifts, or reduced visibility. Also, LiveVox was acquired by NICE, while Lifesize was acquired by Enghouse in 2023.

Final Take

After comparing the two matrices, it is clear that vendors with embedded AI have a competitive edge. Furthermore, vendors that have strong omnichannel strategies also received strong ratings. Several vendors are showing rapid growth, with Dialpad and Enghouse being some of the emerging key players.

In order to stay competitive, vendors in the CCaaS space should demonstrate product innovation, AI maturity, and vertical focus.