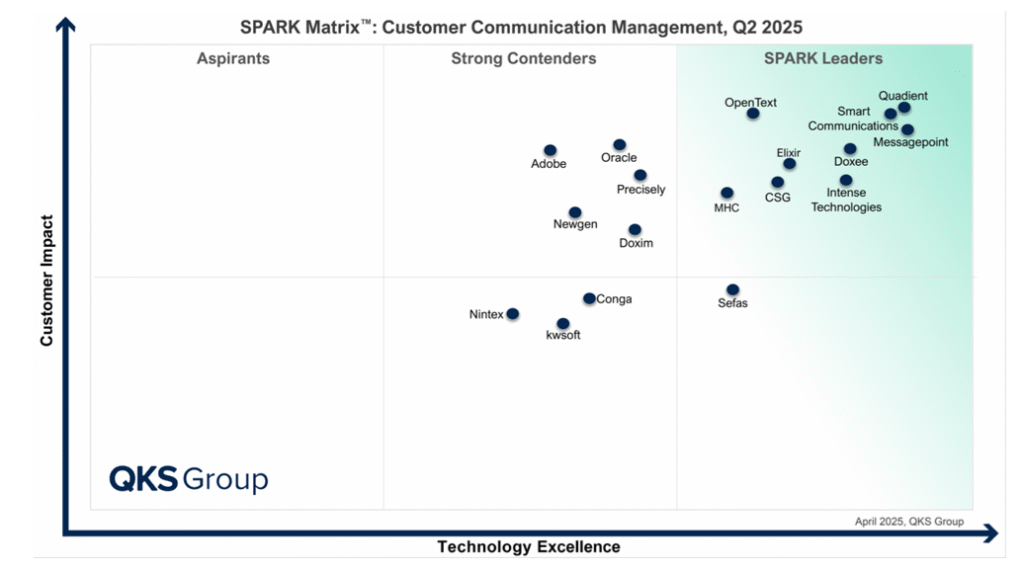

The Customer Communication Management (CCM) space is transforming rapidly. The 2025 SPARK Matrix™ shows a sharper divide between vendors that focus on innovation to keep up with omnichannel demands and those still catching up. From AI-powered orchestration to real-time personalization and compliance-driven content, the expectations from CCM platforms have never been higher.

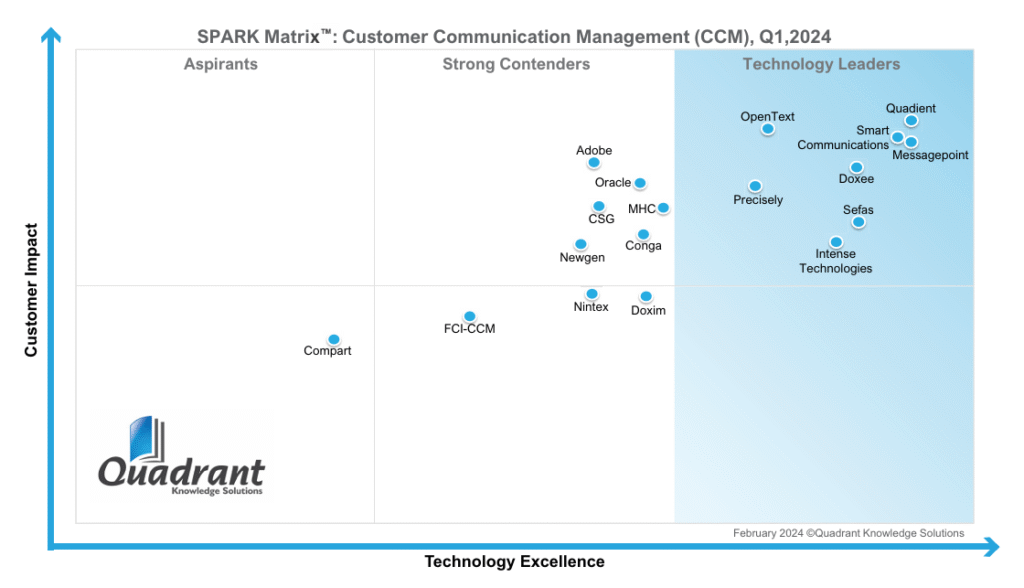

This article will compare the 2024 and 2025 SPARK Matrix for Customer Communication Management, published by QKS Group, formerly Quadrant Knowledge Solutions. It will especially highlight vendors’ strengths and the shifts in vendor positionings.

Leaders That Held Their Ground

Quadient retained its strong Leader position in both 2024 and 2025, with good reason. Quadient continues to push innovation through Inspire Flex and Inspire Evolve, which offer high-performance engines for omnichannel, compliant communications. It also stands out with features like AI scripting assistants, a “Bring Your Own AI” approach, and InspireXpress for intelligent migration from legacy systems. Its leadership position is also attributed to consistent investments in usability and infrastructure modernization.

Smart Communications also maintained its Leader status with its integrated suite of SmartCOMM, SmartIQ, and SmartDX. Together, they enable secure, scalable communication across all customer touchpoints. Other strengths of the company include its forms automation, document generation, and integration flexibility, particularly for highly regulated sectors.

Messagepoint continues to impress with its MARCIE AI engine and Rationalizer tools, which simplify migration and enhance personalization. Its modular approach to variation management helps enterprises create hyper-personalized messaging at scale.

OpenText continues to be a standout performer in the CCM market, retaining its position as a Leader for two consecutive years. Its flagship CCM offering, OpenText Exstream, helps organizations create highly personalized, interactive, and automated communications across print and digital channels. The platform also provides flexibility, offering both on-prem and cloud deployment, which makes it suitable for enterprises with complex infrastructure and compliance needs.

Doxee has maintained its leadership by focusing on enhancing the digital customer experience. What sets it apart is its proprietary platform composed of three distinct modules: Document Experience (dx), Interactive Experience (ix), and Paperless Experience (px). These tools support personalized document generation and engaging, interactive video communications, among others.

Doxee’s strength lies in its ability to turn customer data into immersive storytelling formats that not only inform but engage. The platform’s low-code capabilities and strong integration with CRM systems make it easy to deploy and scale. Doxee’s consistent leadership position reflects its innovation in customer engagement and its strong market traction across industries like telecom, utilities, and financial services.

Intense Technologies has solidified its Leader standing through its UniServe™ NXT platform, an all-in-one suite that integrates CCM with digital customer experience capabilities. The platform enables enterprises to digitize, personalize, and automate their customer communications at scale.

Its strength lies in rapid onboarding, real-time processing, and a scalable microservices architecture. UniServe™ NXT is known for reducing operational costs while simultaneously improving customer engagement, owing to features like dynamic template management and seamless integration with customer data platforms (CDPs). With an emphasis on vertical-specific solutions, particularly in telecom and BFSI, Intense Technologies continues to differentiate itself through both tech excellence and strong customer outcomes.

Although its position shifted slightly lower, Sefas retained its leader status in 2025. Its Harmonie Communication Suite (HCS) offers various robust capabilities. The suite covers the entire CCM spectrum, from design and composition to orchestration, production, and delivery, across both print and digital channels.

What makes Sefas unique is its modular architecture and open APIs, enabling seamless integration with legacy systems and third-party platforms. Its post-composition tools allow for document re-engineering, making it easier for businesses to modernize their legacy communications.

Sefas is especially strong in regulated sectors like healthcare, government, and financial services owing to its built-in audit trails, compliance features, and advanced orchestration tools. The company’s investment in CXM-enhancing features and integrations with CDPs further solidify its position as a future-ready CCM leader.

Climbers in 2025

MHC Software made a significant leap in 2025, moving from Strong Contender to Leader. This shift reflects its continued focus on modernizing the CCM experience through automation, intelligent workflows, and strong integration capabilities. MHC’s platform emphasizes composable architecture, helping businesses create and manage communications across print and digital channels in a flexible, scalable way. The platform is known for its ease of use and strong workflow automation tools, which are particularly useful for industries like healthcare, finance, and manufacturing that demand high-volume, regulatory-compliant communication.

What pushed MHC into leadership territory is its consistent product innovation and improved customer impact. It can also streamline communication processes while enhancing personalization. With stronger customer feedback and improved ratings in user experience, automation, and reporting, MHC’s promotion to the Leaders quadrant is both timely and well-earned.

CSG also climbed into the Leaders quadrant in 2025 after showing steady enhancements across several core CCM competencies. Known for its end-to-end communication capabilities, CSG offers out-of-the-box omnichannel delivery, journey orchestration, and deep personalization features powered by technologies such as conversational AI. Its CCM offering stands out for integrating real-time customer engagement with automated messaging and compliance-oriented workflows, which is increasingly crucial in regulated industries like telecom, financial services, and utilities.

In 2025, CSG received improved scores in both Technology Excellence and Customer Impact. Analysts noted its increased investment in journey analytics, conversational AI integration, and out-of-the-box channel flexibility as major differentiators. The company also demonstrated a stronger product roadmap with enhanced data security, orchestration, and reporting capabilities, justifying its move into the Leaders quadrant.

New Entrants in 2025

Elixir made its way straight to the Leaders quadrant in the 2025 SPARK Matrix. This could be attributed to the company’s expanded investments in automation, workflow orchestration, and ease of use.

At the heart of Elixir’s offering is its flagship platform, Elixir Cloud, which supports a wide range of customer communications, from traditional print to digital-first omnichannel messaging. What makes Elixir stand out is how it balances user-friendly tools for business users with deep configurability for IT teams. Its solution is designed to empower marketing, customer service, and operations teams alike to create dynamic, personalized communications without needing extensive coding expertise.

Another strength is Elixir’s focus on compliance and integration. The platform supports industry-specific use cases, especially in highly regulated environments like healthcare and insurance, where accuracy and audit trails are critical. Its ability to integrate easily with enterprise systems like CRMs and ERPs ensures smooth data flows and reduces operational silos.

In short, Elixir’s 2025 leadership positioning recognizes its maturing product capabilities, commitment to compliance, and a clear roadmap that aligns well with customer needs in an increasingly complex CCM landscape.

kwsoft made its debut in the 2025 SPARK Matrix as a Contender, reflecting its growing presence in the CCM space, particularly in central Europe. Known for its efficient document creation and output management solutions, kwsoft brings decades of experience in regulated industries like insurance and financial services.

Its inclusion this year highlights the platform’s technical robustness, especially in handling high-volume, compliance-driven communications. kwsoft’s steady progress and deep industry specialization suggest strong potential for further growth in the CCM landscape.

Vendors That Slid

Precisely was ranked as a Leader in the 2024 SPARK Matrix for CCM, owing to the broad capabilities of its EngageOne™ suite, which includes tools for interactive documents, personalized video, mobile engagement, and data-driven communications. It has long been recognized for its strengths in data integrity, compliance, and scalable output generation, particularly in industries with high regulatory demands like insurance and financial services.

However, in 2025, Precisely moved to the Strong Contenders quadrant. While the EngageOne platform continues to deliver reliable communication tools and supports a wide range of use cases, it showed a slower pace of innovation compared to rising competitors. Platforms that focused more heavily on cloud-native deployments, AI-driven personalization, and real-time omnichannel orchestration gained ground, especially as customer expectations shifted toward seamless, digital-first experiences.

Precisely remains a strong performer in areas like batch communications, document automation, and back-office integration, and it’s still a solid choice for organizations with large volumes of structured, repeatable communications. That said, the evolving CCM landscape now favors platforms that deliver more agile, interactive, and personalized engagement, especially in customer-facing journeys.

Consistent Strong Contenders

Several vendors—Oracle, Adobe, Newgen, Conga, Nintex, and Doxim—maintained their positions as Strong Contenders in both the 2024 and 2025 SPARK Matrix for CCM. While each brings valuable capabilities to the table, their solutions often support broader enterprise needs beyond just customer communication, which can limit their positioning against more specialized CCM players.

Oracle continues to be positioned as a Strong Contender, offering reliable document automation as part of its broader enterprise application suite. Its CCM capabilities are typically integrated within platforms like Oracle CX and ERP, supporting batch communications, billing, and regulatory documents. While the solutions are scalable and secure, CCM remains a secondary focus rather than a dedicated, fast-evolving product line.

Adobe, while a powerhouse in digital experience, approaches CCM from a broader marketing and content management perspective. While its solutions excel in omnichannel delivery and personalization within its ecosystem, it doesn’t offer a dedicated CCM-first platform in the traditional sense.

Newgen approaches CCM as part of its wider digital transformation suite, which includes enterprise content and business process management. Its CCM capabilities are functional but less advanced when it comes to personalization and omnichannel orchestration.

Conga continues to serve well in contract lifecycle and document generation workflows, especially for legal, sales, and procurement teams. However, it lacks the full breadth of customer engagement tools that define leadership in modern CCM.

Nintex offers communication features as part of its automation and workflow platform. It is effective for internal and operational document generation but lacks the full CCM depth required for high-volume, customer-facing communications.

Doxim continues to be a trusted name in the CCM space, moving up slightly in the 2025 SPARK Matrix. Doxim’s strength lies in its end-to-end managed services model, which combines customer communication, document generation, and statement delivery with deep domain expertise. Its platform supports both digital and print channels, helping organizations transition toward more modern, paperless communication strategies at a comfortable pace.

A Few Exits

FCI-CCM, a Contender, and Compart, an Aspirant, were featured in the 2024 SPARK Matrix but did not appear in the 2025 edition. Their absence may be due to limited global visibility, slower innovation, or a more focused product scope that no longer aligns with the evolving CCM market, which now prioritizes AI-driven personalization, real-time engagement, and omnichannel orchestration. While both platforms remain capable in their niches, they may have fallen short of the updated inclusion criteria for this year’s evaluation.

Final Thoughts

The 2025 SPARK Matrix reflects a maturity curve in the CCM space. Vendors that embraced composability, AI augmentation, and true omnichannel orchestration retained or climbed into the Leaders category. Those who relied too heavily on traditional template-based or batch-driven communication models lost ground.

According to Saurabh Raj, Analyst at QKS Group, “AI is transforming Customer Communication Management (CCM) from a static, rule-based process to a dynamic, intelligent ecosystem. Leading vendors have already embedded AI-driven personalization, workflow automation, and omnichannel orchestration, while others are rapidly advancing their AI roadmaps.”

He further adds, “the future of CCM lies in AI’s ability to generate context-aware content, optimize message timing, and deliver seamless, personalized experiences across multiple channels. As AI continues to evolve, businesses that harness its full potential will redefine how they engage with customers making interactions more relevant, efficient, and customer-centric than ever before.”