The Customer Journey Mapping (CJM) market has witnessed a significant transformation. What was once a space dominated by static visual tools quickly evolved into a landscape filled with intelligent, AI-driven platforms that can orchestrate real-time interactions and connect customer experience initiatives directly to business outcomes.

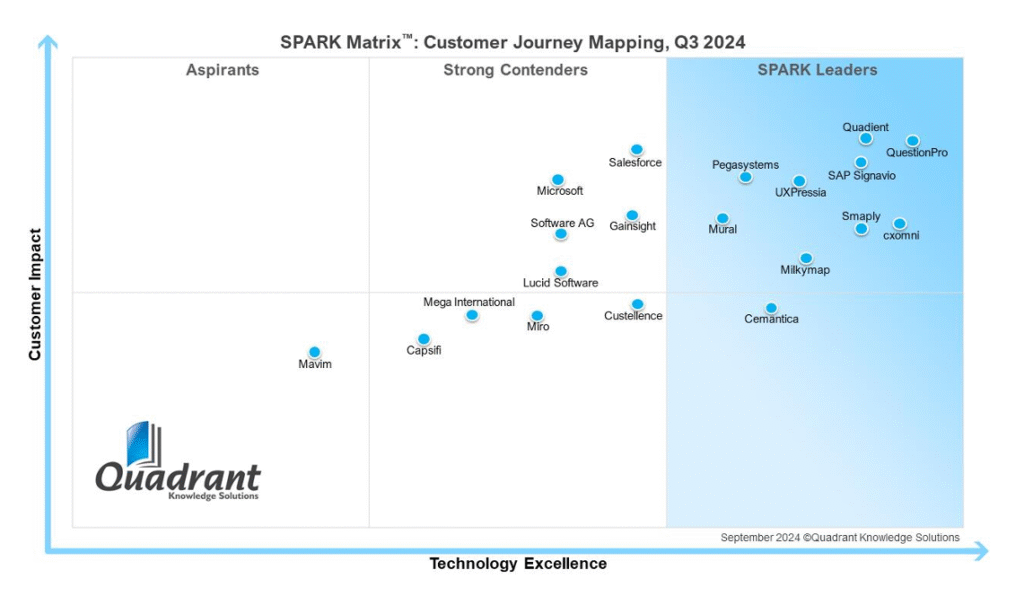

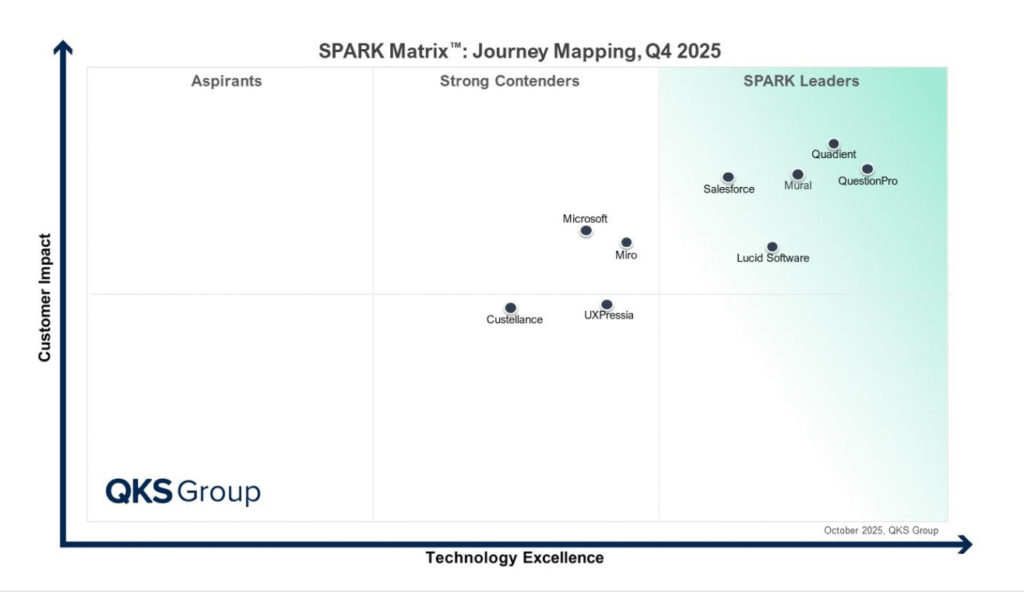

QKS Group, formerly Quadrant Knowledge Solutions, published the SPARK Matrix™ for Customer Journey Mapping in 2024 and Journey Mapping in 2025, which offer a clear view of this transition. By comparing both editions, we can see which vendors have sustained leadership, which have climbed upward, and which are no longer represented in this year’s analysis.

This comparative view also highlights the growing importance of AI, data integration, and cross-functional collaboration as defining differentiators in the CJM technology landscape.

Strong, Steady Performers Hold Their Leadership Status

Despite an increasingly competitive market, several vendors maintained their positions in the Leader quadrant across both years.

Quadient, QuestionPro, and Mural continued to demonstrate robust performance, reinforcing their roles as dependable anchors in the CJM market.

Quadient sustained its prominence with a tightly integrated ecosystem that spans Journey Mapping, communications management, and action planning. Its Inspire Journey platform is particularly suitable for large, multi-brand enterprises and regulated industries that require strong governance, analytics, and persona management capabilities.

QuestionPro retained its leadership through the strength of its unified VoC + Journey platform. It integrates real-time NPS/CSAT data, journey staging, and sentiment analysis, and offers OuterLoop initiative tracking. Its platform is ideal for organizations aiming to ensure CX initiatives translate into measurable improvements.

Mural, meanwhile, maintained its leadership position by anchoring the “collaborative design” end of the market. It offers visual templates, facilitation tools, and enterprise scalability. This make it suitable for journey workshops, design thinking sessions, and distributed CX teams who rely on real-time co-creation.

These vendors demonstrate that consistent innovation, customer-centric execution, and clear enterprise alignment continue to be key to sustained leadership.

New Entrants to Leadership

Two of the most significant movements between 2024 and 2025 come from Salesforce and Lucid Software, both of which moved from Strong Contender in 2024 to Leader in 2025.

Salesforce

In 2024, Salesforce was positioned as a Strong Contender owing to its rich orchestration capabilities. In 2025, it was positioned as a Leader in journey mapping.

This rise reflects several developments:

- Stronger integration between Journey Builder, Data Cloud, and the broader Salesforce ecosystem

- More advanced Einstein AI capabilities enable predictions, segmentation, and next-best-action recommendations

- Expanded adoption of cross-cloud workflows across marketing, sales, and service teams

Salesforce’s shift highlights how orchestration-first platforms are increasingly central to journey management, especially when backed by unified CRM and CDP ecosystems.

Lucid Software

Lucid Software, best known for Lucidchart and Lucidspark, also advanced from Strong Contender in 2024 to Leader in 2025.

This upward movement is largely powered by:

- Increased adoption of Lucid as the go-to workspace for CX, product, and service design teams

- Improved data-linking, template ecosystems, and support for cross-team workflows

- Enterprise-grade governance features make Lucid deployable at a global scale

Though Lucid is not a traditional CJM platform, its strength lies in enabling cross-functional teams to align, design, and document journeys with clarity and structure. Its promotion reflects a market increasingly valuing collaboration and visual intelligence alongside analytics and orchestration.

Strong Contenders in 2025

Vendors such as Microsoft, Miro, Custellence, and UXPressia continue to deliver strong journey-mapping and collaboration capabilities, each serving different CX needs.

Microsoft

Microsoft offers robust real-time orchestration, AI-driven segmentation, and deep ecosystem integration. However, the learning curve and reliance on the Microsoft stack can slow adoption.

Miro

Miro, which was positioned as a Contender in 2024, moved upward in the Strong Contender quadrant in 2025. This reflects broader enterprise adoption and stronger collaborative tooling. The company excels in ideation, workshops, and early-phase journey design.

Custellence

The company offers a flexible, service-design-friendly tool with strong non-linear mapping capabilities. Its intuitive, card-based layout makes it especially suitable for collaborative journey co-creation and iterative CX design.

UXPressia

UXPressia shifted from Leader in 2025 to Contender in 2024, as evaluation criteria increasingly emphasized data depth, integrations, and operational alignment.

The company’s strengths lie in persona design, visual storytelling, and AI-assisted ideation.

These platforms remain well-suited for teams prioritizing design thinking, workshops, and early-stage CX strategy, even as the market moves toward deeper data and orchestration capabilities.

Vendors Featured in 2024

Several vendors featured in the 2024 SPARK Matrix™ for Customer Journey Mapping. These include SAP Signavio, Pegasystems, Smaply, Milkymap, Cemantica, cxomni, Gainsight, Software AG, MEGA International, Capsifi, and Mavim. Their exclusion from the 2025 evaluation is likely owing to shifts in product focus, evolving market definitions, or a narrowed evaluation scope.

Leaders

SAP Signavio was positioned as a Leader in 2024. It offers journey-to-process analytics, automated complexity scoring, and powerful integration with SAP’s process intelligence ecosystem. Its strengths lie in connecting customer touchpoints to operational processes, but its broader focus on enterprise transformation may have placed it outside the 2025 journey-mapping criteria.

Pegasystems, also positioned as a Leader in 2024, provides strong customer journey orchestration, event-driven engagement, and decisioning capabilities powered by AI. Its platform leans more heavily toward real-time interaction management and workflow automation. This makes it more aligned with enterprise decisioning than with pure visual journey mapping.

Smaply is known for its easy-to-use journey visualization, persona tools, and hierarchical mapping structures that support service design teams, which positioned it as a Leader in 2024. The platform is popular for workshop-driven CX work.

Milkymap, a Leader in 2024, offers structured journey mapping, standardized experience frameworks, and experience-level agreements (XLAs). Milkymap mainly focuses on documentation and governance.

cxomni supports detailed journey analytics, touchpoint repositories, and omnichannel data overlays that help teams connect CX insights to performance metrics. It was positioned as a Leader in 2024. However, as CX converges toward broader experience platforms, its specialized capabilities may not have fully aligned with the 2025 evaluation direction.

Cemantica provides clear, template-driven journey mapping, persona management, and VoC integration for mid-sized organizations, positioning it as a Leader in 2024. Its scope remains strong for mapping and discovery work, though its lighter orchestration features may not meet the expanded criteria used in 2025.

Contenders

Gainsight, a Strong Contender in 2024, has robust customer health scoring, lifecycle management, and journey design capabilities integrated with CS operations. While highly effective for customer success teams, it has repositioned toward CS platforms rather than standalone CJM.

Software AG excels in process modeling, customer journey overlays, and deep enterprise architecture governance, which positioned it as a Strong Contender in 2024. Its strengths remain in process transformation rather than dedicated CJM, and its emphasis on BPM methodologies could have placed it adjacent to the 2025 evaluation scope.

MEGA International provides journey-linked process modeling, enterprise architecture, and actionable insights via its HOPEX platform. It was positioned as a Contender in 2024. Its capabilities support end-to-end transformation rather than standalone journey mapping, which could have contributed to a shift in category alignment.

Capsifi, a Contender in 2024, integrates journey mapping with business architecture, capability modeling, and strategic planning. Its holistic, enterprise-wide modeling approach remains valuable but lies closer to digital architecture and transformation planning than to CJM-specific workflows emphasized in 2025.

Mavim was positioned as an Aspirant in the 2024 evaluation. It combines customer journeys with process mining, operating models, and transformation roadmaps. Its journey features remain strong in process alignment, though the 2025 scope’s focus on real-time data and AI-driven optimization may have shifted attention toward other specialized platforms.

Across these vendors, the common themes are strategic realignment, category evolution, or expanded platform scope, factors that often place them adjacent to, rather than inside, this year’s journey-mapping evaluation. Many continue to play an important role in process intelligence, service design, and enterprise transformation.

Key Takeaways

The differences between the 2024 and 2025 SPARK Matrix™ reveal several decisive market trends:

- Journey Mapping is evolving into Journey Management, with orchestration and continuous improvement becoming core expectations.

- AI is now a major differentiator, from persona creation to predictive modeling and automated insight generation.

- Collaboration remains central, especially for distributed CX, product, and service-design teams.

- Integration ecosystems matter, with CDPs, CRMs, and analytics tools increasingly intertwined with journey workflows.

Platforms that can unify data, streamline collaboration, and drive real-time improvements continue to rise in the rankings.

Looking Ahead: The Next Shift in Customer Journey Platforms

The next generation of journey platforms will lean heavily on:

- Real-time behavioral data ingestion

- Predictive and prescriptive AI

- Seamless orchestration across channels and systems

- Cross-functional collaboration at enterprise scale

- Hyper-personalized, dynamically adaptive journeys

As customer experiences grow more nonlinear and more data-rich, the vendors that emerge ahead will be the ones capable of turning journey maps into living, intelligent systems guiding customer experience execution in real time.