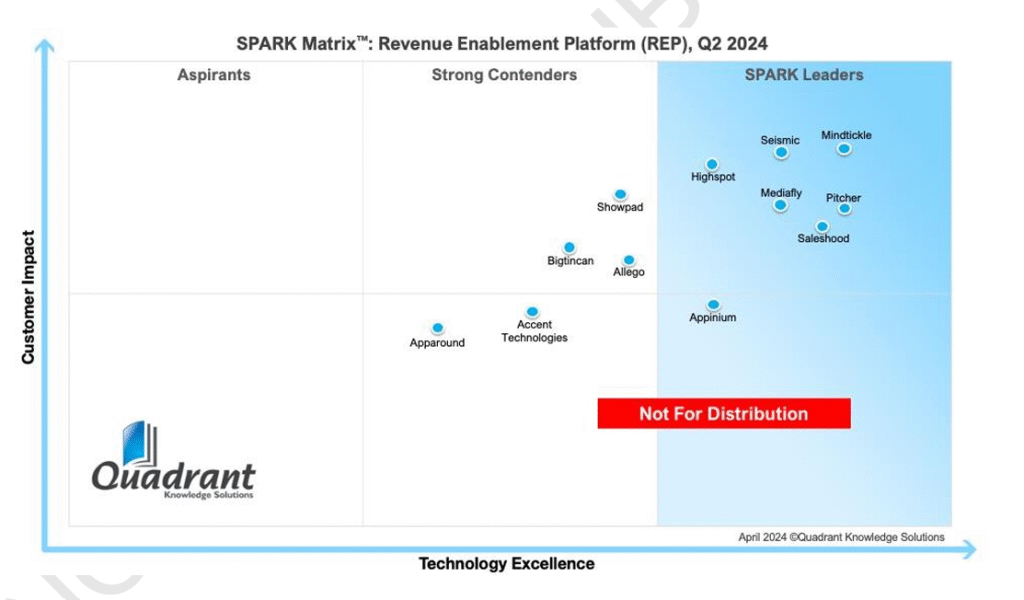

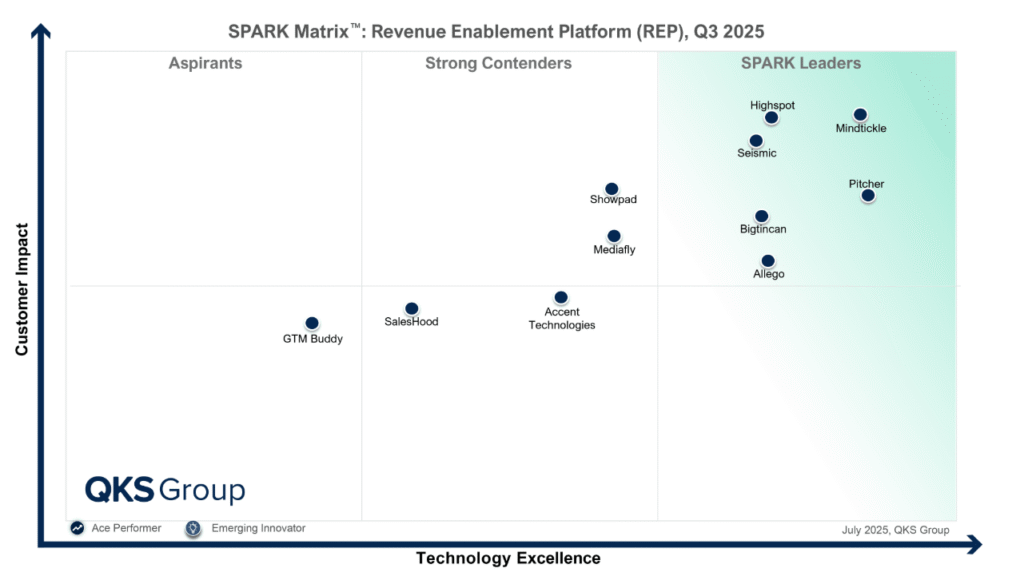

The Revenue Enablement Platform (REP) market is undergoing a significant transformation, driven by advancements in AI, enhanced integrations, and a growing emphasis on streamlined sales and marketing alignment. QKS Group, formerly Quadrant Knowledge Solutions, has released its SPARK Matrix™ for 2025, providing a detailed assessment of vendor performance based on Technology Excellence and Customer Impact. By comparing this with the 2024 edition, we can identify which vendors have progressed, remained steady, and shifted their market position.

According to Vaishnavi, Research Analyst at QKS Group, “Vendors featured in these reports represent a curated list from the broader sales enablement market. The critical differentiator is that these vendors have stood out and excelled in a landscape that has evolved significantly to reflect the growing need for cohesion between modern organizations’ marketing and sales teams.”

She further adds, “These vendors are recognized for deeply embedding AI across seller workflows, from dynamic pitch practice and just-in-time content generation to AI-based next-best-action recommendations. Their strong integrations with sales, marketing, and revenue intelligence systems, combined with mobile-first design and tailored partnerships, make them highly adaptable, workflow-centric solutions for modern revenue teams.”

The Top Performers

The majority of vendors ranked as Leaders in 2024 have maintained their positions in 2025, with two notable promotions from Strong Contender to Leader. This stability reflects their ability to adapt to changing market demands and enhance core capabilities. Below are insights into the strengths of returning Leaders and the new additions to this category.

Highspot continues its strong showing as a Leader in both 2024 and 2025. Its platform, featuring Highspot Copilot for AI-driven content creation and integrations with Salesforce and Zoom, remains a standout for training engagement and partnerships with sales training providers like Challenger and Sandler.

Mindtickle retains its Leader status, with its Co-Pilot AI for role-plays and Sales Readiness Index, supported by integrations with Salesforce and Seismic, solidifying its position. The company maintains a focus on industries such as BFSI and healthcare.

Seismic holds firm as a Leader, with its Enablement Cloud, including Aura Copilot and LiveSocial, leveraging integrations like Veeva and Gong. Its emphasis on social selling and extensive ecosystem support keeps it prominent.

Pitcher maintains its Leader ranking, driven by industry-specific customizations for healthcare and CPG, along with its Multichannel module for WhatsApp integration. Its roadmap toward multimodal AI suggests ongoing development.

Allego was elevated to Leader in 2025 from Strong Contender in 2024, with its AI-powered coaching and over 140 integrations (e.g., HubSpot, Salesforce) boosting its standing. Its compliance features, such as GDPR support, add to its appeal.

Bigtincan, positioned as a Strong Contender in 2024, was promoted to Leader in 2025, with its Genie AI, XR capabilities, and mobile-first approach, with integrations like Salesforce and AWS highlighting its growth. Its focus on usability enhancements is a key factor.

Consistent Contenders

Two vendors held steady as Strong Contenders across both years, offering reliable solutions with room for further evolution.

Accent Technologies remained a Strong Contender in 2024 and 2025, excelling with AI-driven insights via Accent Assist and BI integrations (e.g., Tableau, Power BI). Its focus on seller-buyer interaction analysis remains a strength.

Showpad was also positioned as a Strong Contender for two consecutive years, with its AI Coach and 3D/AR capabilities via Threekit, along with integrations like Salesforce and Marketo, maintaining its relevance.

Contenders in 2025

Mediafly, previously a leader, was positioned as a strong contender in 2025. Its AI coaching and SAP integration are particularly suited for pipeline analytics. However, its modular structure continues to shape its market approach.

SalesHood, a leader in 2024, was positioned as a strong contender in 2025, with its proprietary LLM and MEDDICC AI enhancing its offerings, supported by a user-friendly UI, despite some integration considerations.

New Entrant in 2025

GTM Buddy debuts as an Aspirant in 2025, bringing AI-powered LMS and Meeting Prep features, with integrations like Salesloft and HubSpot. Its focus on mid-market users shows promise, though its geographic reach is currently limited to India and the USA.

Vendors No Longer Featured

Appinium was a Leader in 2024 but has not been included in the 2025 matrix. This may be due to shifts in market focus or strategic realignment, though its previous strengths in Salesforce integration and LMS capabilities were notable.

Apparound was featured as a Strong Contender in 2024. Its absence in the 2025 matrix possibly reflects a narrower product scope or reduced visibility in the latest evaluation, given its prior emphasis on content management.

Key Observations

The 2025 SPARK Matrix underscores a market maturing toward AI-driven workflows, with leaders excelling in real-time coaching, content personalization, and robust integrations. Digital Sales Rooms (DSRs) and immersive technologies like AR/VR continue to gain traction, while seamless connectivity with CRM and CPQ systems remains critical. Vendors maintaining or advancing their positions have prioritized scalability and user experience, aligning with the needs of modern revenue teams.

Looking Ahead

The REP landscape in 2025 highlights the importance of innovation and adaptability. Vendors that integrate AI, enhance usability, and expand their ecosystems are well-positioned for growth. As the market evolves, those focusing on connected go-to-market strategies and measurable outcomes will likely lead the way.