In today’s experience-first economy, brands are expected to offer a seamless customer experience, irrespective of channels, with precision and empathy. For companies providing CX Management Services, the bar keeps getting higher — and the competition is increasing.

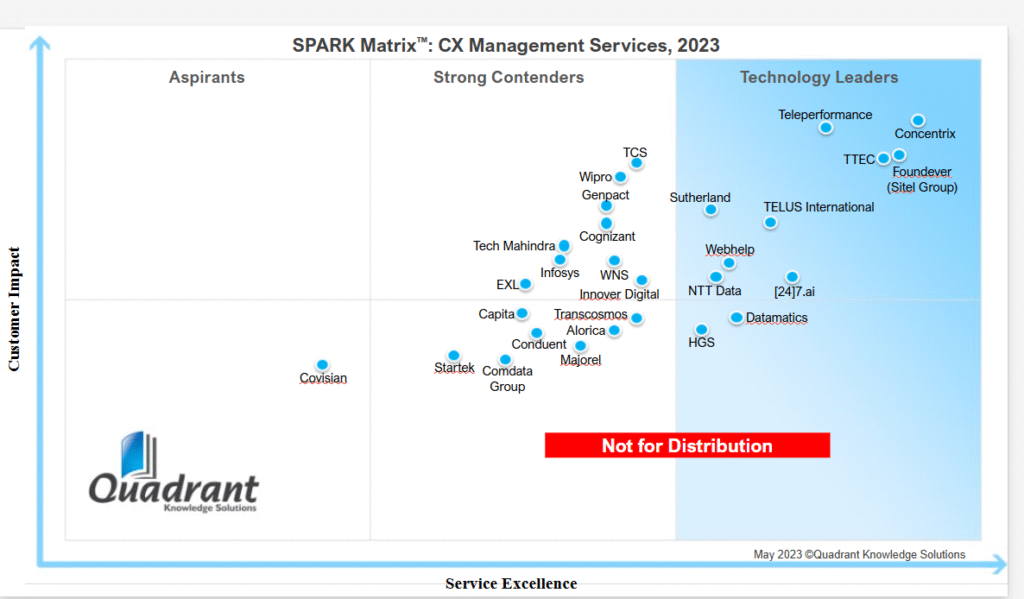

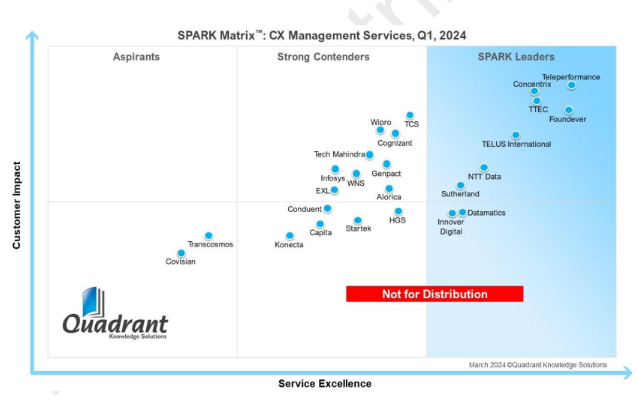

The SPARK Matrix™ from QKS Group (formerly Quadrant Knowledge Solutions) provides a research-driven analysis and ranks service providers in terms of both technology excellence and customer impact.

This article compares the 2023 and 2024 editions of the SPARK Matrix for CX Management Services to see who moved, who stayed put, and who slipped off the radar.

Here’s what the comparison reveals, and why it matters.

Consistent Leaders

Some providers have managed to do what many can’t — maintain their position at the top.

Teleperformance, Concentrix, TTEC, and Foundever (previously Sitel Group) continue to hold a strong position in the Leader quadrant for two consecutive years. These vendors develop dedicated frameworks based on specific use cases. They are recognized for operational scale, technology-driven services, and a distinct digital transformation vision in CX.

What differentiates them isn’t just their size, it’s their ability to evolve. They incorporate AI, automation, and vertical-specific CX models while consistently maintaining service quality across regions and channels. These companies have demonstrated that they can keep up with an age of rapidly evolving customer expectations.

Players that showed Momentum

Some vendors made noticeable strides, improving their standing in the 2024 Matrix.

TELUS International has moved up higher to the leader zone. Its initiatives around digital consulting, automation, and next-gen CX delivery have improved its standing in the SPARK Matrix.

NTT Data also moved up, particularly on the customer impact axis. This could be due to its investment in industry-specific solutions and more integrated digital delivery models. They also offer engaging and personalized experiences for customers across various channels.

These cases highlight how vendors that invest in targeted innovation are starting to see it reflected in how the market perceives them.

Familiar Contenders: Strong, but Static

A few providers retained their place in the strong contender category with little to no movement between the two years.

Genpact, Cognizant, Infosys, Wipro, Tech Mahindra, WNS, EXL, and Alorica all fall under this category.

This consistency indicates reliability and maturity but also brings into question whether these vendors are innovating fast enough. This is especially true in a space where AI, hyper-personalization, and agile delivery models are now the norm.

These businesses have the infrastructure, client base, and expertise, but may need to redefine their differentiation to make it into the leadership category.

Featured in One, not the Other

Some interesting developments were seen while comparing matrices. [24]7.ai, Webhelp, Majorel, and Comdata Group were featured in the 2023 SPARK Matrix but were absent in the 2024 Matrix.

Their absence could be due to consolidation activity (for instance, Webhelp’s acquisition by Concentrix and Majorel’s acquisition by Teleperformance) or internal restructuring. Some may have shifted their focus to specialized verticals or geographies or may have moved away from broad-based CX services that are evaluated for the SPARK Matrix, leading to their exclusion in 2024.

The Aspirants

Covisian stayed in the Aspirant quadrant across both years, while Transcosmos moved from the Contender section to the Aspirant section in 2024. Although both offer comprehensive CX management solutions and service expertise, the data suggests they might not have scaled innovation or improved client outcomes on a global scale.

Final Take

The SPARK Matrix is a reflection of how vendors are ranked in terms of execution, strategy, and innovation. Service providers are improving their service offerings by investing in sophisticated technologies such as conversational AI and marketing automation. While some vendors have clearly focused on transformation and reaped the benefits, others may need to rethink their game plan before the next evaluation cycle.