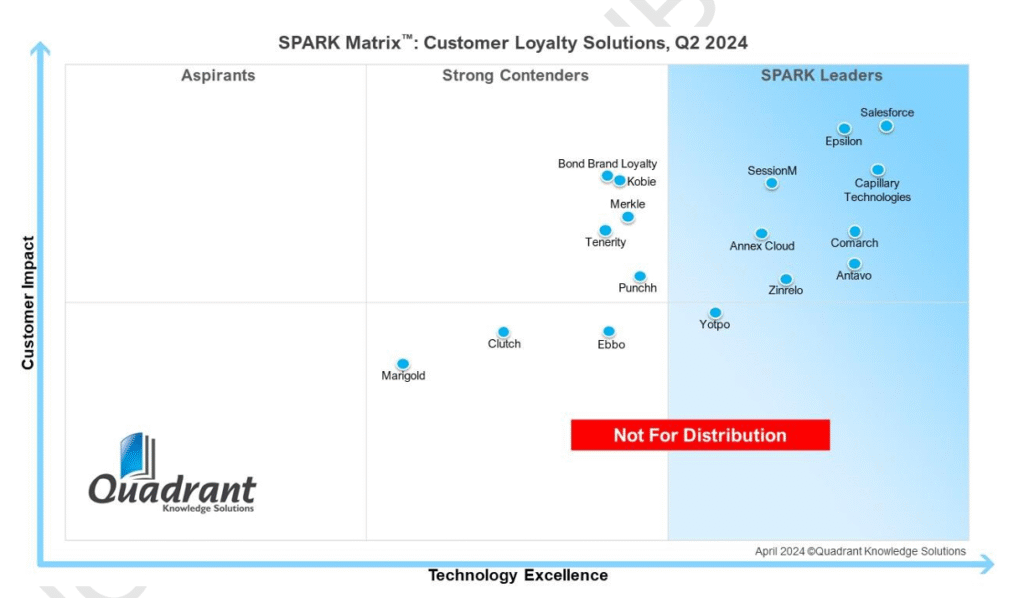

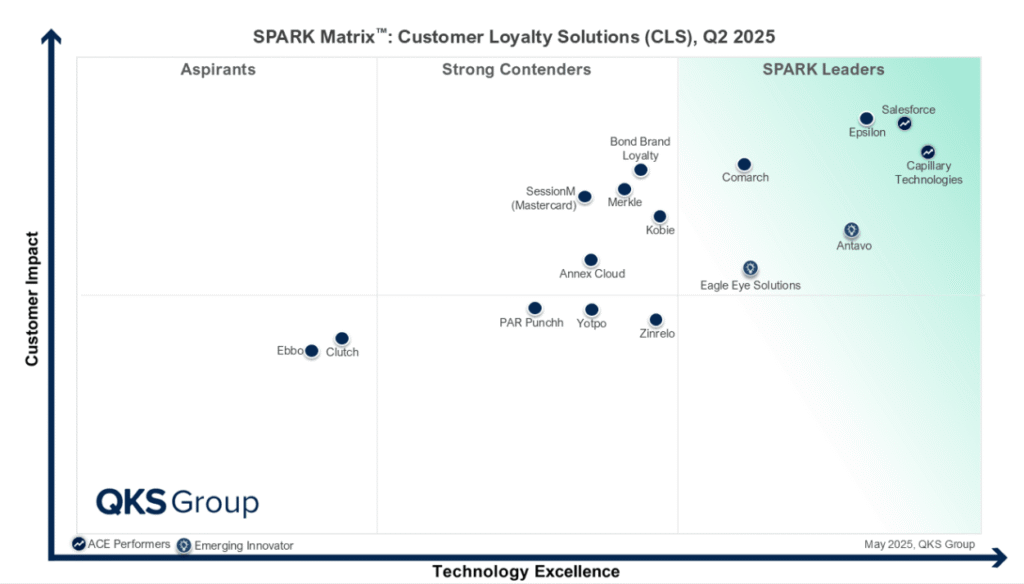

The Customer Loyalty Solutions (CLS) market is undergoing a remarkable transformation, driven by the demand for personalized engagement, omnichannel experiences, and cutting-edge technologies like AI. The SPARK Matrix™ by QKS Group, formerly Quadrant Knowledge Solutions, provides a detailed evaluation of this dynamic landscape, assessing vendors on Technology Excellence and Customer Impact. Let’s explore the shifts in vendor positioning between the 2024 and 2025 editions, released in Q2 of each year, and what these changes signify for the industry, based on the 2024 and 2025 SPARK Matrix™ reports.

Market Overview: CLS in 2024 and 2025

The Customer Loyalty Solutions (CLS) market has experienced significant evolution, driven by the growing need for enhanced customer retention, engagement, and personalized experiences across diverse industries. The 2024 SPARK Matrix™: Customer Loyalty Solutions (CLS) set the stage, highlighting a competitive landscape where advanced technologies began shaping customer-centric strategies. By 2025, the market matured further, with an increased emphasis on innovation, scalability, and seamless integration across multiple channels. Its applications span retail, hospitality, financial services, and beyond, where CLS platforms are used to design reward programs, optimize customer journeys, ensure compliance, and foster long-term brand loyalty through data-driven insights and automated workflows. This progression reflects a market increasingly attuned to meeting the dynamic expectations of businesses and consumers alike.

Leading Vendors: Maintaining and Expanding Influence

Salesforce has retained its Leader position from 2024 to 2025, building on its Salesforce Loyalty Management platform within the Marketing Cloud. The 2024 introduction of Agentforce, an AI-driven suite launched in October 2024, enhances program management and personalization, reinforcing its enterprise-grade scalability.

Epsilon also held its Leader status from 2024 to 2025, leveraging its CORE ID and AI-driven personalization through its global marketing platform. The improvements in self-service UI and data management have sustained its strong customer impact.

Capillary Technologies maintained its Leader ranking in both 2024 and 2025, with its Loyalty+ and Insights+ suite. The 2025 enhancements with AiRA (AI Research Assistant) and the Nudge framework boost its AI-powered personalization and emotional loyalty measurement.

Comarch was also positioned as a Leader in 2024 and 2025, driven by its advanced fraud detection and member profile management using AI/ML. Its 2025 focus on data security and interoperability has solidified its position in regulated sectors.

Antavo retained its Leader status from 2024 into 2025, with the 2024 rebranding to Antavo AI Loyalty Cloud and the introduction of Loyalty Planner and Timi AI enhancing its implementation speed and customization, particularly in Europe.

Eagle Eye Solutions emerged as a Leader in the 2025 SPARK Matrix. Its AIR Wallet and capacity to handle over 1 billion personalized offers per week reflect significant scalability and omnichannel personalization advancements.

Steady Contenders: Consistent Performance

Bond Brand Loyalty remained a Strong Contender from 2024 to 2025, enhancing its Synapze LX with emotional loyalty measurement via the Customer Genome, though its global reach continues to develop.

Kobie stayed a Strong Contender, maintaining its Triple Play Data™ and 3-tiered gamification, which provide deep personalization, though it has not yet scaled to leader-level market presence.

Merkle held its Strong Contender position, with LoyaltyPlus and the 2023 GenCX AI solution advancing its offerings, though deployment ease remains a challenge.

Punchh also retained its position as a Contender, offering robust omnichannel loyalty solutions, with steady performance in retail and hospitality, though it lacks the broad AI integration of leaders.

Adjusted Positions: Shifts in the Landscape

SessionM, a Leader in 2024, shifted to a Strong Contender in 2025. This change may reflect its focus on Mastercard ecosystem integration and Dynamic Yield enhancements and not on keeping pace with the rapid AI and omnichannel innovations demanded by the leadership tier.

Annex Cloud, a Leader in 2024, moved to a Strong Contender in 2025. The November 2024 OneView Commerce partnership for POS integration improved its capabilities, but its market impact may not have scaled sufficiently to retain leadership.

Zinrelo, a Leader in 2024, transitioned to a Strong Contender in 2025. Its multi-dimensional loyalty and professional services remain strong, but a potential lag in AI adoption or global expansion could explain the shift.

Yotpo, a Leader in 2024, became a Strong Contender in 2025. Its focus on eCommerce with flexible rewards and real-time tracking continues, though it may not have matched the comprehensive innovation of leaders.

Ebbo, a Strong Contender in 2024, moved to an Aspirant in 2025. Its diverse loyalty programs and end-to-end support are solid, but a potential lack of scalability or innovation in AI-driven features may have contributed to this shift.

Clutch, a Strong Contender in 2024, transitioned to an Aspirant in 2025. Its B2C focus with ML-driven journeys remains, but it may not have expanded its technological scope to meet the higher standards of contenders.

Vendors No Longer Featured

Some vendors that were featured in 2024 were not included in the 2025 evaluation. This may be due to a shift in QKS’s focus on vendors with broader AI and omnichannel impact or changes in these vendors’ market strategies or visibility.

Tenerity, a Strong Contender in 2024, is absent from the 2025 leadership or contender categories, possibly due to a shift in market focus or reduced visibility in the updated evaluation criteria.

Marigold, a Strong Contender in 2024, is not featured in the 2025 leadership or contender ranks, which may reflect a strategic pivot or insufficient alignment with the 2025 focus on AI and omnichannel orchestration.

Insights from the Shift

The movement from 2024 to 2025 highlights a market prioritizing AI (e.g., Antavo’s Timi AI, Capillary Technologies’s AiRA), omnichannel scalability (Eagle Eye Solutions’s AIR Wallet), and emotional engagement (Kobie’s Emotional Loyalty Scoring). Vendors maintaining or gaining leadership have aligned with these trends, while shifts to contender or aspirant status may reflect challenges in scaling innovation or meeting new criteria.

Looking Ahead

The 2025 SPARK Matrix™ underscores a maturing CLS market where innovation drives leadership. Vendors aiming to advance should focus on AI, global reach, and compliance, while businesses should seek partners aligning with these priorities. The absence of some players suggests an opportunity for emerging vendors to engage with QKS for future inclusion.