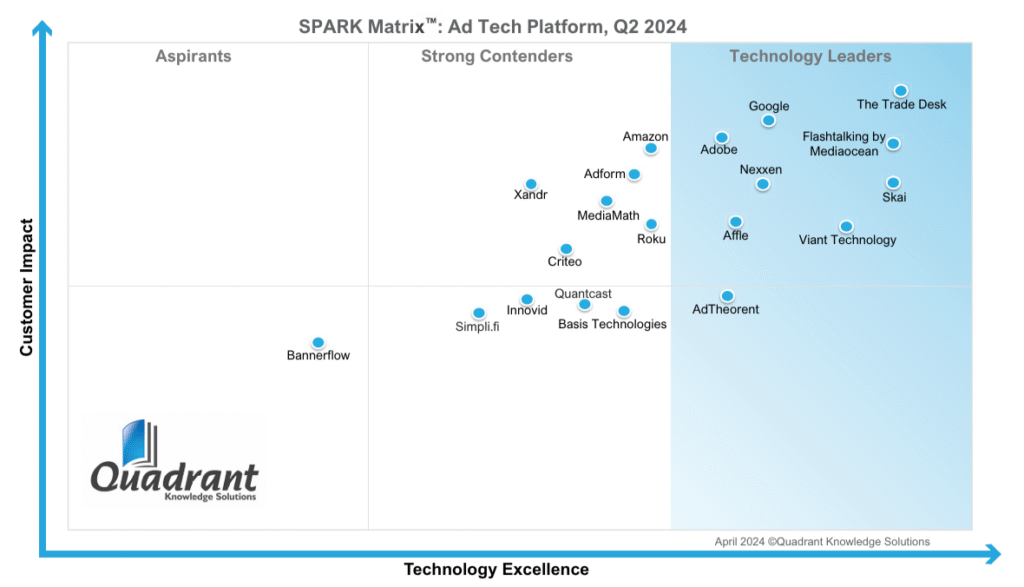

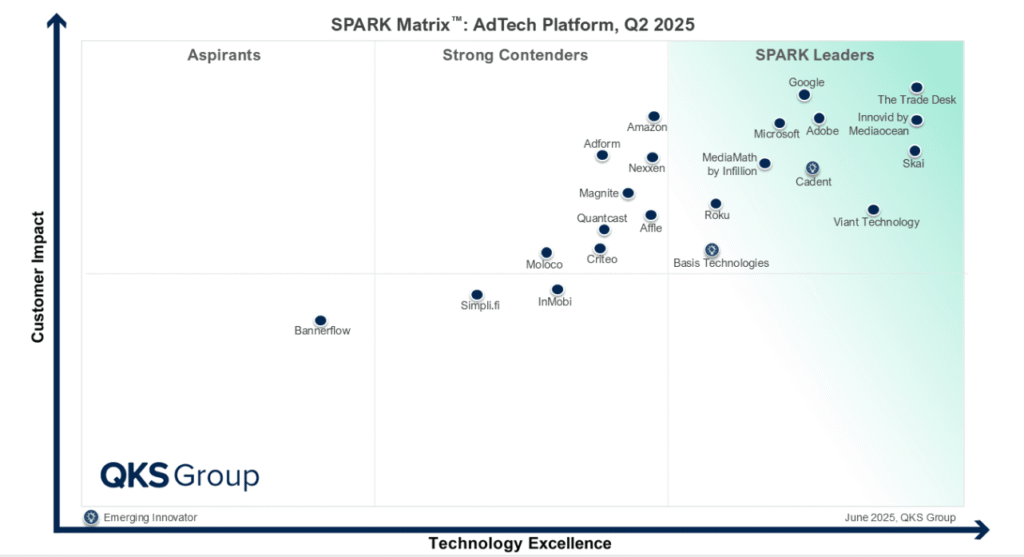

The AdTech Platform market is undergoing a transformative phase, driven by AI advancements, seamless integrations, and a growing need for aligned sales and marketing strategies. QKS Group, formerly Quadrant Knowledge Solutions, has released its SPARK Matrix™ for 2025, evaluating vendors on Technology Excellence and Customer Impact. Comparing this with the 2024 edition reveals significant shifts in vendor standings.

Market Overview: AdTech in 2024 and 2025

The AdTech Platform market has evolved rapidly, driven by the demand for sophisticated programmatic buying, data management, and multi-channel campaigns. The 2024 SPARK Matrix™ established a competitive landscape where emerging technologies began reshaping advertising. In 2025, the market has matured, with a stronger focus on AI optimization, privacy compliance, and CTV growth. These platforms support display, video, mobile, and retail media, enhancing campaign precision and real-time insights, reflecting a market attuned to modern advertiser needs.

According to Richa Choubey, Senior Analyst at QKS Group, “The contrast between 2024 and 2025 marks a significant evolution in the way AdTech platforms are being architected, adopted, and leveraged. In 2024, the focus was largely on regaining control, mitigating identity deprecation, adapting to signal loss, and stabilizing performance across increasingly fragmented media channels. Most platforms were still refining their AI models, aligning them with new compliance standards, and working through integration gaps that limited unified campaign execution.

By 2025, the conversation has moved beyond stabilization toward orchestration. AI is no longer treated as an enhancement but embedded across the campaign lifecycle from planning and targeting to creative adaptation and measurement. There’s a notable shift in how platforms position themselves not as isolated bidding engines but as connective tissue linking creative, audience intelligence, and outcome measurement in real time.

She further adds, “What’s also changed is the level of transparency and explainability buyers now expect. While 2024 was about proving functionality, 2025 demands strategic accountability. Platforms that have responded with deeper identity graphs, consent-aware data stitching, and better alignment with retail media ecosystems are finding themselves in stronger positions. It’s no longer just about performance, but about delivering insight, agility, and control in a post-cookie, AI-native world.”

The Leaders

While several vendors retained their position as Leaders through 2025, there are also new vendors featured in the Leaders’ quadrant in the 2025 SPARK Matrix™.

AdTheorent was positioned as a Leader in the 2024 Matrix. It was then acquired by Cadent, which also featured as a Leader in the 2025 Matrix. The acquisition enhanced its predictive AI (Predict, Assemble, Orchestrate) and omnichannel capabilities, solidifying its position.

Google held its Leader status in 2024 and 2025. Its ML ecosystem (DV360, Privacy Sandbox) and vast inventory continue to dominate technology and market presence.

Skai was also positioned as a Leader for both years. The 2025 GenAI agent Celeste and retail media integrations (e.g., Walmart) strengthened its strategic edge.

Viant Technology was a Leader in both 2024 and 2025. The 2024 ViantAI launch and 2025 IRIS.TV acquisition reinforced its AI and CTV leadership.

The Trade Desk retained its Leader position in 2024 and 2025. The 2025 Koa™ AI and Seeds enhancements cemented its technological and market leadership.

MediaMath by Infillion rose from Contender in 2024 to Leader in 2025. The 2025 Infillion rebranding and composable DSP with retail support drive this promotion.

Microsoft made its way straight into the Leader quadrant in 2025. Its AI-powered Copilot with LinkedIn/Xbox integration and cost-effective bidding mark a strong debut.

Innovid shifted from Contender in 2024 to Leader in 2025 owing to its strategic acquisition by Mediaocean and the subsequent integration with Flashtalking (which was positioned as a Leader in the 2024 SPARK Matrix), creating a unified platform that excels in video advertising and beyond. This transformation leveraged Mediaocean’s expansion into ad verification and Innovid’s strengths in omnichannel delivery, interactive CTV ads, and supply path optimization.

Roku advanced from Contender in 2024 to Leader in 2025. Its 2025 CTV dominance, cross-identity tools, and interactive ads fueled this rise.

Basis Technologies also moved from Contender in 2024 to Leader in 2025. Its 2025 workflow automation and fraud prevention enhancements supported this leap.

Steady Contenders

The 2025 Strong Contender category includes six vendors, with some maintaining 2024 positions and others shifting.

Adform remained a Strong Contender in both years. Its 2025 FLOW platform and ID Fusion are robust, though onboarding complexity limits progress.

Amazon Ads also held steady as a Strong Contender. Its 2025 retail media strength persists, constrained by high CPCs and limited reach.

Criteo was positioned as a Strong Contender for two consecutive years. Its 2025 commerce AI focus remains strong, despite transparency challenges.

Affle dropped from Leader in 2024 to Strong Contender in 2025. Scalability issues or limited market expansion beyond mobile may have influenced this shift.

Magnite debuted as a Strong Contender in 2025. Its 2025 SpringServe unification for CTV/OTT monetization established a niche.

Quantcast rose from Contender in 2024 to Strong Contender in 2025. Its 2025 cookieless targeting with probabilistic modeling boosted its standing.

Emerging Players and Transitions

Bannerflow was the only Aspirant in both 2024 and 2025. Its 2025 creative automation focus stays niche, restricting broader impact.

InMobi was positioned as a Contender in 2025. Its mobile-first DSP and geo-fencing gained traction, though approval delays may have limited growth.

Moloco featured as a Contender in 2025. Its 2025 ML-driven mobile optimization shows promise, with limited omnichannel scope.

Nexxen shifted from Leader in 2024 to Contender in 2025. Possible support responsiveness issues or slower innovation rollouts may have contributed.

Simpli.fi stayed a Contender in both years. Its 2025 hyperlocal targeting and AI Autopilot remain niche, with manual backend challenges unchanged.

Vendors Not Included

A vendor from the 2024 matrix was absent in 2025, reflecting potential changes in market focus or evaluation criteria. Xandr, a Contender in 2024, was not featured in the 2025 matrix. This could be due to strategic realignment, market consolidation, or a shift in QKS Group’s vendor selection focus.

Key Insights from these Shifts

The 2024 to 2025 transition highlights a market prioritizing AI/ML (e.g., Microsoft’s Copilot and Basis Technologies’ automation), privacy solutions (e.g., Quantcast’s cookieless targeting), and CTV expansion (e.g., Roku and Magnite). Vendors maintaining or gaining leadership have leveraged acquisitions (e.g., Cadent-AdTheorent) and new tools, while certain shifts (Affle, Nexxen) may reflect execution or scalability challenges. The absence of some players suggests opportunities for emerging vendors.

Future Outlook

The 2025 SPARK Matrix™ reveals a maturing AdTech market where innovation in AI, privacy, and omnichannel strategies drives success. Advanced AI technologies are revolutionizing campaign efficiency and personalization, positioning leaders to thrive. Privacy solutions are gaining prominence as regulatory pressures increase, offering a competitive advantage to those who adapt. Simultaneously, omnichannel approaches are shaping the industry by enabling seamless engagement across multiple platforms. Vendors excelling in these areas are well-positioned for growth.