The Workforce Engagement Management (WEM) market continues to evolve rapidly as enterprises respond to hybrid work demands, rising attrition, and the need to enhance customer experiences. The 2025 SPARK Matrix™ from QKS Group (formerly Quadrant Knowledge Solutions) underscores this evolution, highlighting platforms that have embraced AI, real-time analytics, and employee-centric engagement as key differentiators.

According to Amandeep Singh, Associate Director & Principal Analyst at QKS Group, “Workforce Engagement Management is undergoing its most profound transition yet. Once defined by scheduling and compliance, it is now being reimagined through AI as a dynamic ecosystem that predicts workforce needs, personalizes coaching at scale, and turns employee engagement into a measurable business advantage. The 2024–2025 period marks the shift from managing the workforce to empowering it, with AI as the bridge between efficiency and human potential.”

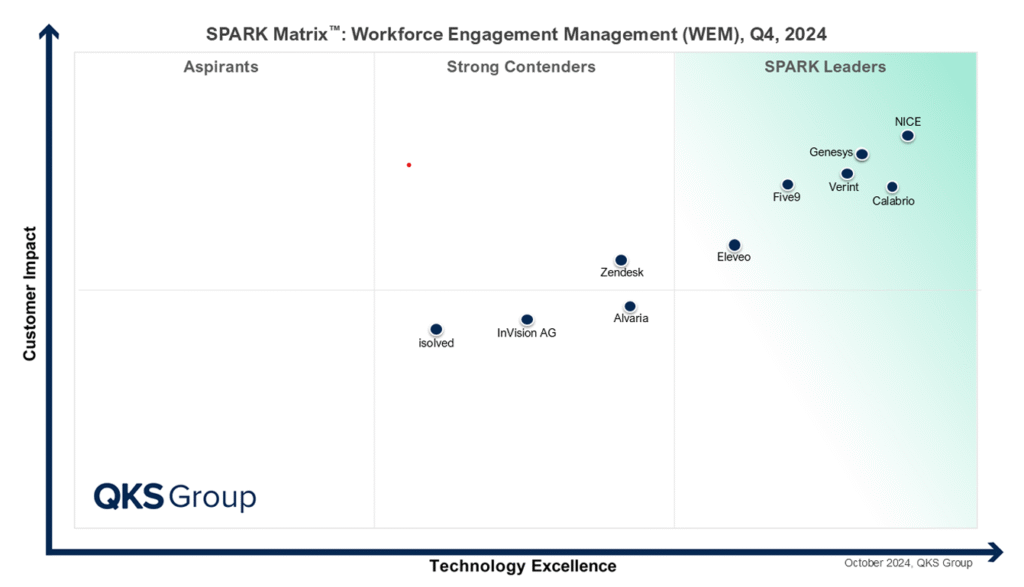

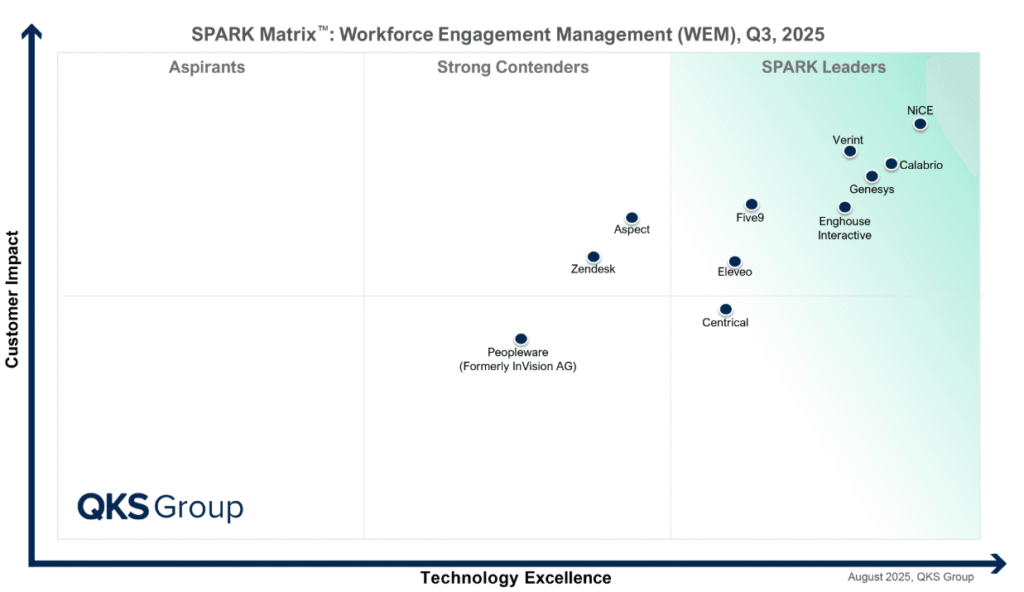

This blog compares the 2024 and 2025 SPARK Matrix™ for WEM, revealing which vendors retained leadership, who advanced, and how the market is adapting to new demands.

Steadfast Leaders

NICE

NICE featured as a leader in both 2024 and 2025, anchored by CXone’s unified WEM stack and Enlighten AI plus Nexidia analytics. Its strengths remain AI-driven forecasting, dynamic scheduling, automated QM, and broad omnichannel analytics, well suited to global, complex operations. Some buyers phase adoption to unlock the full depth of analytics and automation, but the platform’s scale, maturity, and continuous innovation keep NICE at the forefront of Technology Excellence and Customer Impact.

Verint

Verint was also positioned as a leader for two consecutive years, with a subtle uptick in Technology Excellence, driven by its Da Vinci AI and Open CCaaS strategy. The suite covers forecasting, scheduling, quality management/compliance, performance, and engagement, and includes an open data and integration framework designed for use with various technology stacks. Organizations value the modular path to value; the main task is operationalizing advanced capabilities for measurable outcomes. Verint’s ecosystem and AI depth underpin strong, durable leadership.

Genesys

Genesys also remained a leader, coupling WEM tightly with Genesys Cloud CX and its Experience Orchestration vision. Embedded WEM in environments like ServiceNow and AI features such as auto-summarization and intent capture streamline post-interaction workflows. The new multi-panel agent desktop (2025 rollout) reduces context switching. Some innovations are still in phased release, but the CX-integrated approach, APIs, and global footprint sustain high Customer Impact.

Calabrio

Calabrio retained its leader standing, driven by its cloud-first Calabrio ONE and practical AI (e.g., Auto QM, AI summaries, sentiment via Echo AI). Customers highlight the integrated suite, including recording, QM, WFM, analytics, as well as ease of use. Strategic CCaaS partnerships (Amazon Connect, Genesys, NICE CXone) simplify deployments. To grow enterprise share, Calabrio is addressing advanced compliance/local hosting scenarios and deep configurability, while preserving its strong mid-market appeal.

Five9

Five9 also stayed in the leader quadrant. Its WEM is natively integrated into the Intelligent CX Platform, combining transcription, sentiment, AI-driven QM scoring, and microservices scalability. Agent autonomy (mobile access, gamification, self-service scheduling) resonates in hybrid teams. Some administrators note complexity in large-scale evaluation setups, but Five9’s cloud architecture and CRM/ITSM integrations continue to deliver solid Customer Impact.

Eleveo

Eleveo maintained its leader status in 2024 and 2025, showing consistency for mid-sized contact centers seeking a modular, cloud-first WEM stack. It covers recording, QM, WFM, and analytics with intuitive UX and short implementations, plus growing AI for Auto-QM and speech analytics. Strengths include flexibility and integration with major PBX/CCaaS systems. Brand awareness and depth in certain regions are still expanding, yet its pragmatic value keeps it firmly in Leadership.

New and Rising Leaders

Centrical

Centrical makes its debut in the Leader quadrant in 2025, excelling in gamification, microlearning, and personalized engagement. By enabling real-time feedback and recognition, Centrical addresses both motivation and skill development, making it a standout in driving sustained workforce performance.

Enghouse Interactive

Enghouse Interactive entered the Leader quadrant in 2025 owing to the strength of its core WFM/QM/recording, AI-assisted summarization/transcription, and flexible cloud/hybrid/on-premise options. Tight alignment with Enghouse’s own CCaaS platforms simplifies workflows for existing customers, while video knowledge management aids onboarding and training. Visibility varies by region and some advanced AI-coaching use cases are evolving, but the balanced portfolio and deployment flexibility explain why Enghouse was included in the Leadership category.

Consistent Strong Contenders

Aspect (formerly Alvaria)

Aspect advanced from contender in 2024 to strong contender in 2025, leveraging deep WFM/QM heritage while modernizing for cloud and AI. Investments target AI forecasting, agent coaching, and scalability, with flexible deployment models that suit regulated sectors. The priorities ahead are continued architectural modernization, amplified brand momentum post spin-off, and deeper CCaaS/UCaaS/digital integrations to match buyers’ composable CX strategies.

Zendesk

Zendesk remains a Strong Contender on the strength of native WEM built from Tymeshift (WFM) and Klaus (QA). Auto QA, ML-based forecasting, and in-platform agent visibility streamline day-to-day operations for teams already on Zendesk. Supervisors benefit from live adherence and SLA dashboards. To push into Leadership, Zendesk is expanding structured coaching, gamification, and cross-platform interoperability for multi-vendor environments while maintaining ease within its own ecosystem.

Peopleware (formerly InVision AG)

Peopleware was featured as a contender in both years, with a modular, employee-centric approach spanning planning, QA, coaching, performance, and feedback. Design rooted in wellbeing, including pulse surveys, micro-feedback, and sentiment, helps predict burnout risks early. Open APIs and connectors reduce integration friction. The sweet spot is mid-market and public sector; ongoing work focuses on large-enterprise scalability and broader global presence, especially across APAC and Latin America.

Vendor Not Featured in 2025

isolved was featured as a contender in 2024 but was absent in 2025’s WEM Matrix. This could be because it appears to have shifted focus away from contact center-oriented WEM or is in a strategic phase not captured in the latest evaluation. Its departure may reflect a narrower scope rather than a decline in offering quality.

Insights from the Shifts

- Expanded Leadership: The 2025 Matrix welcomed Centrical and Enghouse Interactive alongside established Leaders NICE, Verint, Genesys, Calabrio, Five9, and Eleveo.

- Driven by AI & Engagement: Real-time analytics, automated coaching, gamification, and sentiment insights are now table stakes.

- Composable architectures win: Open data and seamless CRM/CCaaS integration are critical for adoption in diverse enterprise environments.

- Mid-market strategy: Players like Aspect and Peopleware are leaning into modularity and usability to compete effectively.

Conclusion

The 2025 SPARK Matrix™ for Workforce Engagement Management highlights a market at the intersection of technology innovation and employee experience. Established Leaders like NICE, Verint, and Genesys continue to set the benchmark, while new entrants such as Centrical and Enghouse Interactive underscore the growing importance of engagement, flexibility, and AI-driven insights. The shift from operational efficiency to holistic workforce empowerment reflects broader trends in hybrid work, talent retention, and customer experience excellence. As WEM solutions become more intelligent, integrated, and employee-centric, vendors that combine robust functionality with measurable business outcomes will define the next phase of leadership in this evolving space.